Here are 6 practices across customer experience, technology, cost-saving and business growth that could help hospitality operators thrive post-pandemic:

1. Digital menus and digital ordering

This has probably been the stand out success story of the pandemic for operators navigating the lockdown restrictions. Following the government mandate that tableside ordering was required for all indoor and outdoor dining, the adoption of mobile ordering and the use of digital menus has soared. Although adoption was already happening within the QSR and fast-casual space, the restrictions pushed many customers and operators across all sectors into an accelerated adoption providing a myriad of benefits.

Higher average order value

The user journey of digital menus can be engineered to provide multiple upsell opportunities or subtly promote premium items on the menu with visual cues resulting in consistently higher average order values.

Better customer service

Allowing customers to self-order and pay via their phone has freed up front of house staff to give better customer service when fulfilling orders and because orders go straight to the kitchen from the customer, the preparation time is quicker too.

Menu reinvention

Supply and labour restrictions meant many restaurants had to pare down their menu but it has also been an opportunity to reevaluate and reinvent their offering to reflect the changing customer sentiment and behaviour. They have been able to monitor and adapt to food trends such as plant-based, vegan, gluten-free etc and update digital menus instantly.

Of course, mobile ordering works better in some sectors than others. Fast food and QSRs lend themselves well to this model but for some premium and fine dining restaurants, the engagement with the server and perusing a paper menu is part of the dining experience. Often a talented server can bring dishes alive and encourage diners to go for more courses than planned so upselling is not just the reserve of digital ordering.

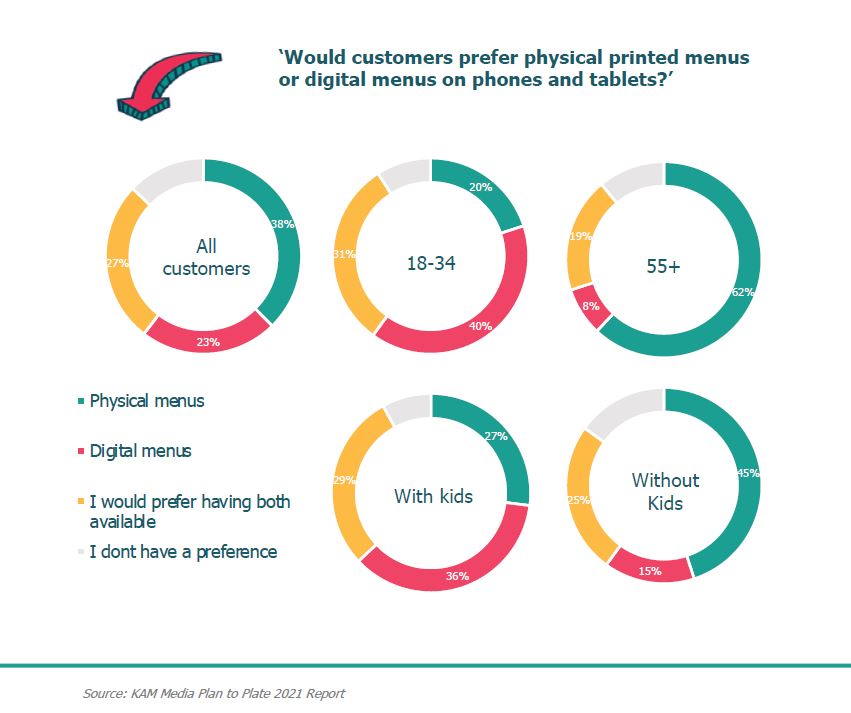

The customer type is also a factor for digital vs. printed menu preference with younger, more tech native demographics favouring digital along with those ordering with kids because they cab order at their convenience.

Often a hybrid approach is best to give the customer the most choice and ensure they are comfortable as we emerge from the pandemic. One such approach could be offering wipe free physical menus and the option to either view or order and pay from a digital menu. From a sustainable point of view, a paper-free or recycled paper option could be preferable to an increasingly eco-conscious customer.

2. Cashless payments

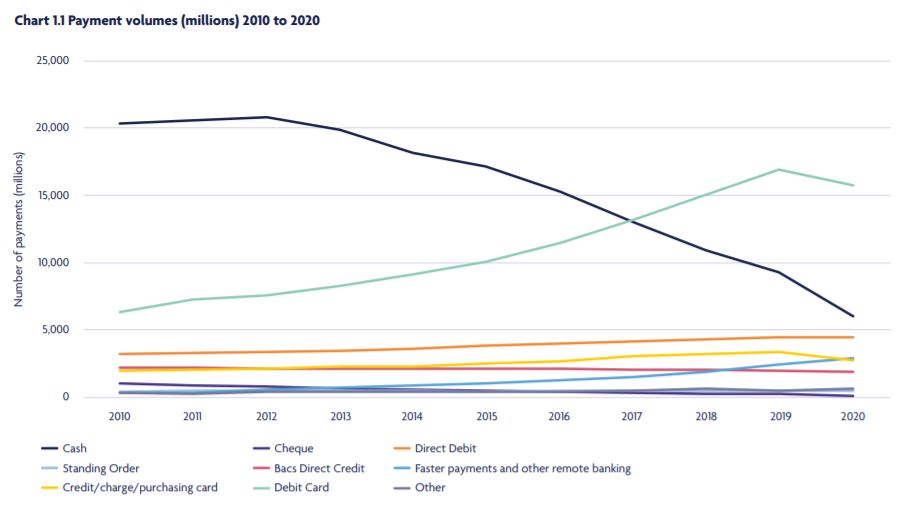

Cashless payments were not a product of the pandemic but have certainly been a catalyst to our increased preference for cashless transactions as the graph from UK Finance shows the sharp decline in cash use (just 17% of all payments in 2020). Although the WHO quickly clarified that cash was not a super-spreader of the virus, people and businesses have instinctively opted to use contactless methods of payment to limit any transferal risks.

What are the benefits?

For consumers, contactless card payments represent a convenient and safe way to make payments and usage increased by 12% in 2020. According to UK Finance, this is due to a number of factors, namely:

- The spending limit increased to £45 in April 2020 for contactless payment.

- Operators encouraging consumers to use contactless PoS during the pandemic.

- Continued uptake of card acceptance devices by smaller businesses.

- Consumers becoming increasingly comfortable and familiar with contactless payments.

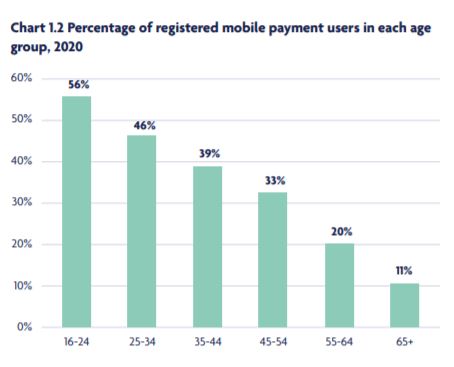

Mobile payments have experienced an even larger rise in use during the pandemic with registration for mobile payments in UK adults up 75% to 7.4 million in 2020 compared to the previous year. Unsurprisingly the largest uptake for Apple, Google and Samsung Pay are amongst the 16-24-year-old age group as this graph from UK Finance shows:

For operators, the evidence is overwhelming that cashless transactions are a growing preference for nearly all age groups. But providing this as the only option could be seen as a step too far however many operators have taken the pandemic as the ideal time to transition to cashless such as The Lucky Onion hotel and gastropub group.

One of their sites, The George Hotel opened exclusively as 100% cashless and have found many benefits including significant time-saving. As Head of Operations, Phil Brown says “Cashing up is now a 30-second process for our staff which before could take hours across all the sites, and we have no mitigating losses from banking or input errors.”

3. Brand diversification

2020 was all about brand diversification and for some, this was not a product of long term strategy but sheer business survival. In 2019 you would never expect to see fine dining restaurants offering takeaway, dine at-home kits and live stream cookery demonstrations but these were just some of the new revenue streams that these brands were forced to pivot to out of necessity.

For many brands like Michelin-starred chef Simon Rogan, what was born out of necessity has now been retained post-lockdown as a proven and successful revenue stream i.e. the Simon Rogan at home range.

Examples of brand diversifications/new revenue streams

- Takeaway

- At-home meal kits

- At-home drinks kits

- Retail – cookery books, branded ingredients like sauces

- Self-serve kiosks in third party outlets (e.g. Costa Express in service stations, Carluccio’s vending machines in Budgens supermarkets)

Benefits for operators and customers

Extra revenue stream

Being able to gain revenue while in-house dining restrictions have keep restaurants and pubs shut has been a key reason to pivot into one of these brand diversifications. Offering takeaway has been the clear go-to for many restaurants brands who never offered this service pre-pandemic. Stats from CGA show that takeaways are still accounting for 35% of sales even now dining-in has returned. This represents an increase of 225% in sales compared to June 2019.

Data collection

An immensely useful by-product of this diversification and omnichannel approach has been data collection across takeaway be it delivery or click and collect, retail, at-home offering and online engagement like Instagram Live. By tracking customer behaviour across all these channels, brands have gained a more enriched customer view from which to tailor varying offers. They have also been able to use this data to make decisions on menu structure and choice, merchandising, pricing and promotions.

Personal brand engagement

In turn, customers have been able to access a more personal view of their favourite brand by supporting their new brand extensions and engaging with the people behind the brand i.e posing questions live to high profile chefs as they cook.

Equally the generosity of brands in devoting their time, money and resources to helping others during the pandemic such as the wonderful Feed the NHS initiative has shown the human and compassionate side of these businesses (when they too were struggling). This has provided a great deal of brand equity for the likes of Leon, Dishoom and Tortilla (to name but a few) who got involved from the start.

Future-proofing

Nothing is certain but spreading the risk for the business across a number of revenue streams is a great way for operators to safeguard against any future need for closure of in-house dining (fingers-crossed we don’t see another pandemic anytime soon).

4. Hybrid working

The trend for hybrid working during the pandemic looks set to stay post-pandemic as employers are increasingly adaptable to reduced time in the office and employees working from home. This offers a great opportunity for pubs, restaurants and coffee shops to provide an alternative working environment for those whose home isn’t conducive to working from home or those who just want a change of scene.

A KAM Media snap poll found that almost one in four “hybrid workers” consider hospitality venues an acceptable place to work remotely. Pubs, restaurants and coffee shops are particularly attractive to younger “hybrid workers”, with 26% of Generation Z and younger Millennials saying they would consider working remotely from these venues, compared with just 7% of over-55s who prefer to work from home or at a dedicated co-working space.

Top 5 things customers want from a venue offering remote working:

- Fast and reliable Wi-Fi connection

- Great coffee

- Minimal music

- Plug sockets

- Great lunch options

For minimal effort, operators can provide favourable conditions for hybrid workers and ensure business outside of the usual dayparts. Indeed, the poll found 12% of hybrid workers would be interested in a monthly subscription for limitless hot drinks or soft drinks thus guaranteeing a loyal and consistent customer base.

Managing director of KAM Media, Katy Moses said: “The industry needs to continue to think differently and give customers every reason to want to visit, whatever the time of day. More than ever, we can’t rely on what has worked in the past.”

5. Experiential hospitality concepts

One trend that seems to have gained traction during the lockdown is the growing appetite for experiential hospitality venues that offer some kind of sport or leisure experience alongside a bar or restaurant offering. It’s no wonder the popularity of these have moved from a pre-pandemic epicentre of London to a wider UK audience as people are drawn to places where they can once again socialise with friends and family in an exciting environment. This post-lockdown sentiment has been likened to the roaring 1920s where people were coming out of a post-war period of austerity and restriction with a new affection for spending time with friends and family, socialising, and living life to the full.

London still houses the highest concentration of this type of experiences such as Bounce (ping pong), Pitch (golf), Queens (ice skating and bowling), Flight Club (darts) and Plonk (crazy golf).

Re-purposing high street locations

All the above concepts are starting to open up outside the London area but one of the most interesting hospitality ideas to come on the back of the pandemic and the similar crisis within the retail sector is the repurposing of large high street retail units into experiential spaces. An example of this is the Southside shopping centre in Wandsworth where the team behind trampoline park operator Gravity is opening a £6m multi-attraction that will offer eight immersive experiences under one roof.

Mark Allan, boss of the UK’s biggest property company, Landsec, thinks a quarter of what is currently retail space will need to be turned into something else purely because it has no further relevance as a retail destination but actually lends itself perfecting to an experiential venue makeover that post-lockdown audiences are craving.

6. Increased hand hygiene and surface hygiene

Ok, so this last one is a bit obvious but nevertheless, a no-brainer to carry on practising and promoting by operators. Handwashing and thorough surface cleaning are key when it comes to reducing the proliferation of germs and containing the spread of not only Covid-19 but other more common pathogens like salmonella and Ecoli etc. All germs that, when an outbreak is very severe, can shut down premises or at the very least cause some staff absences and poorly customers.

Effective hand hygiene, using alcohol-based hand sanitiser, or washing with soap and water, is the greatest single measure your staff and customers can take to prevent the spread of pathogens. Wall-mounted dispensers and freestanding hand hygiene stations offering hand sanitiser and disinfectant wipes should be accessible at all common touch points like entrances, waiting areas, bars and toilets.

Using signage and in-house comms to promote handwashing and reassure customers that food is handled with the highest hygiene standards can also help to allay any fears and build trust, particularly for your more cautious customers.

In summary, the absolute worse thing that any hospitality business can do is come back exactly the same as they were pre-pandemic. There have been fundamental changes in people’s feelings around social contact and hygiene, acceptance of technology, and a reminder of what’s really important in their lives when it comes to the life/work balance. Hospitality brands have to adapt and accommodate these sentiment changes into their business plan to really come back stronger and profit from these fundamental cultural shifts in our new post-pandemic world.