Introduction

There has been a plethora of Mobile Order & Pay suppliers offering their services as we ease out of lockdown but choosing the best solution can be a minefield of options. To help simplify things a little, we take a look at the main features of the tech, the pros and cons of these and importantly, the key questions you should be asking potential suppliers when selecting your order & pay solution.

What is Mobile Order & Pay in a nutshell?

It is a software solution that allows your customers to access your menu and order their food and drink either at the table or off site for click & collect or delivery all via an app. It’s by no means a new tech solution as QSR and fast casual brands like Starbucks and Dominoes have been using a dedicated order app for some time with excellent results but it’s now a reduced-contact solution that brands from all sectors are clamouring for to help their indoor service operate within social distancing guidelines (2 metres ideally but no less than 1 metre plus in England).

What are the options? Pros & Cons

Basically, there are two routes to take, either a native app that your customers need to download or a web app which is browser-based so requires internet access for use and can be accessed via a QR code or a venue’s Wi-Fi login.

The broad advantage of offering a web app for customers is simply app download fatigue where we know that people only use a very limited number of apps – and only keep newly downloaded apps for a short period. A WI5 survey found that 69% of 18-34s would use mobile ordering more if they did not have to download an app.

Apps can also take up valuable storage space so the value proposition for consumers to take the trouble to download an app has to be high but offering free food or drinks for just downloading the app is one incentive that has proven to work well. Web apps, on the other hand, offer frictionless sign-up with little register info required and if, done via social sign-up, then none at all.

From an operator point of view, web apps are cheaper and quicker to develop as they are not device specific because they are browser based. For the same reason they are easier to maintain and update if your menu or customer offers change frequently.

On the flip side native apps can have much higher functionality options because once your customer downloads them the app has full access to useful phone functionalities such as push notifications, bluetooth for beacon location-based tech, camera, QR scanner, mobile pay options with NFC (near-field communication) – all elements that can make marketing to your customer more effective and simplifying their order journey to be quick and frictionless. Plus once downloaded, your brand is with your customer wherever they take their phone and for most of us that’s pretty much everywhere.

Native apps are more expensive particularly if they need to be compatible across multiple platforms. They require a number of steps by your customer to access – go to app store, locate, accept T&C’s, download, register details – all this can deter impatient customers who just want to order a pizza. Your app will also need to get approval from the app store and incur costs doing so (this is usually part of the developer’s job however and part of the dev fee).

Once all this is done, they can be used offline and are not only more feature-rich but tend to be safer and more secure thanks to app store approval requirements.

Lastly one consideration that affects both native and web apps is the cost associated with payment processing fees which can be as much as 6% although tend to average between 2 and 3 %. Although this cannot be avoided, it is something for operators to bear in mind when choosing a Mobile Order & Pay solution.

Ok so what are their main features, and which do I need?

Menu ordering

Customers can access an operator’s full menu and make individual or group orders. For some supplier solutions like WI5 this can include selecting portion size or modifiers, instant re-ordering and real-time notification of out-of-stock items.

For those that use a native app solution, beacon tech can be used to indicate to staff where customers are sitting once they place their order which provides a sleek way to streamline the delivery of their order with no need for additional interaction with staff like the old-school table number on a wooden spoon for example. A useful feature for larger quick-service venues where a fast table turnaround time is crucial.

Allergen, nutritional & dietary highlighting

we know how important allergen info is with the upcoming Natasha’s Law legislation. Equally those with a strict dietary need such as Halal or Vegan would welcome dietary highlighting on F&B. OrderPay’s app includes haptic allergen alerts for customers wearing Apple Watches when allergens they have identified are present in any of their selected orders.

Social ordering

To cover all touchpoints, Restolab mobile ordering solution allows customers to order from the brands Facebook page with payment integration. Another way brands can offer ordering where their customers are hanging out on social media.

Scheduled menus

if menus are limited based on time of day i.e. lunch menu or happy hour menu for pubs then these can be scheduled by the operator so that customer can only see the available menu’s in real-time.

Up-selling/cross-selling to increase transaction value

When ordering certain items, customers can see prompts on deals and promos like 2-4-1s or BOGOF. OrderPay’s ‘Smart Waiter’ function automatically prompts customers on refills or desserts after mains to increase individual transaction value.

Order customisation

- Customers can make special requests on orders such as specific allergies, or general preferences.

- Customers can add items to a favourites list to streamline their future orders.

Payment options

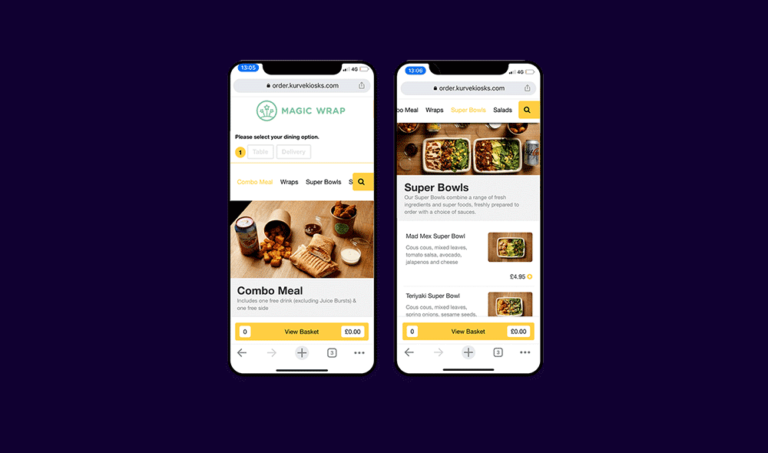

The list of these varies depending on the supplier but you should expect the bare minimum of options to include the standard debit/credit card and PayPal and then additional mobile pay options such as Apple Pay or Android Pay would be beneficial given it’s a mobile solution. Suppliers like Kurve and WI5 both offer this flexibility with their solutions.

The digital wallet option works with a phone’s NFC allowing customers to use contactless card machines just like a debit/credit card. This option is great for Food-to-go operators like Pret who use OrderPay’s ‘Tap & Go’ self-serve which enables customers to open their OrderPay app and tap their phone to the corresponding shelf label under their sandwich to pay and go – no need to queue and the transaction is taken care of via their linked mobile pay wallet. We know these solutions have been used by Amazon Go shops and in many leading supermarket metro shops with great success so utilising the same tech in food-to-go and fast casual sectors makes sense to reduce human contact.

In addition to payment method, flexibility and simplicity is just as important for a fluid UX customer journey and so solutions that include bill splitting, one-click ordering and emailed receipts are all great to give the customer a frictionless experience.

Click & Collect and/or delivery

For QSR/Fast Casual sectors, a click & collect function is a must. The best solutions are those that keep the customer fully informed so that brands can not only manage but exceed expectation and keep customers coming back. Functions such as giving customers scheduled pick-up times and order progress (when food is being prepared, ready for collection) are all key to this communication.

Native apps can also use the phone functionality to turn customers phones into a buzzer for order collection notification which gives them the chance to wait off-site, again limiting their proximity to other customers and staff.

Table booking

For casual and fine-dining operators, this is an extra functionality that allows the app to complete the entire customer journey – book table, order and pay at table all via the one app.

EPoS integration

Having a Mobile Order & Pay solution integrate with your EPoS system is a key consideration when selecting your supplier. Market-leading EPoS suppliers like pointOne are built on an open platform which means that we can integrate with all leading Mobile Order & Pay solutions. The advantage of this for operators is that it allows crucial data to be shared between systems giving you a fluid customer experience, increased operational efficiency and valuable insight into customer behavioural data.

For example, stock levels can be monitored in real-time as orders are placed which means operators can manage stock and avoid having to tell customers a dish is off the menu. As many operators will be looking to offer a tighter post-COVID menu with reduced supply chains, this information on customer demand and preference is even more important in helping reduce wastage and keep top sellers on the menu.

For multisite operators, an effective EPoS integration means that site-specific menus or promos that are working well on the mobile app at one venue can be easily rolled out to another venue via the EPoS.

The integration between your mobile ordering app and your EPoS is also the key to unlocking key customer behaviour data as it allows customer spend to be linked to previous transactions to build a better understanding of their preferences. Armed with this information you can then use your mobile app to send outbound marketing messages. For those using a native app, this can be push notifications direct to your customer and beacon tech means you can go one step further and reach out to your loyal customers when they may be passing by one of your venues and perhaps lure them in with a timely and personalised offer via SMS or email.

Back-Office functionality

Marketing & CRM

As we touched on above, the marketing capabilities and customer insight available from mobile ordering apps is powerful, particularly when combined with your existing marketing, loyalty and CRM software. When they all share transactional and behaviour data, you can build up a detailed picture of your customer and what they respond to which makes your ability to push out highly personalised, timely and relevant marketing campaigns both possible and effective.

Operator dashboard

All leading Mobile Order & Pay apps feature a back-office operator dashboard where you can see all user analytics and run data insight reporting in addition to centralised menu management including the set-up of real-time promos, price changes etc.

Aggregator apps – best of both worlds?

We know the obstacles to customers downloading a native app but aggregator apps like OrderPay mean that a customer only needs to download the OrderPay app once to unlock all the functionality and native app advantages across a range of brands. This is because OrderPay ‘re-skins’ and locks the app to a particular brand as a customer crosses the venue’s entrance, so only that brand’s menu is accessible when in venue, eliminating the need for consumers to download numerous apps.

This means, thanks to beacon tech, a customer with an OrderPay app is served the right operator branding, menu, offers and order options when they are in the venue. Or if they are opting to order for click & collect or delivery, they can simply search for their chosen brand and be taken to the re-skinned version.

Lastly, the questions you should be asking Mobile Order & Pay suppliers when selecting your partner?

Data security, like with using any third-party software, should be a high priority and as Mobile Ordering & Pay apps need to deal with highly sensitive data like customer payment details, you must feel confident that your chosen supplier has the appropriate safeguards for handling this.

Ask the right questions:

- Is the supplier GDPR compliant in data capture? Given that operators are now being asked to help with the government’s track and trace by taking customers details when they arrive at their venues, using a service that is fully GDPR compliant is essential.

- What accreditation do they have to safeguard customer data?

- Who is the acquiring bank? And what are the associated processing fees? As a financial institution which accepts and processes credit and debit cards transactions on behalf of merchants, they need to be reputable but also affordable.

- What is the on-boarding/installation process?

- Do they offer 24/7 customer support? You need to know you can get assistance during your business hours which for hospitality is often late at night and over weekends.

- Do they offer training? Is it remote, on-site, management team or individual?

- It’s always a good idea to look at who else the supplier is working with. Are their clients working in a similar sector to yours showing that their solution is one that is experienced with your particular business needs. Review their case studies and testimonials and if possible, speak to one of their clients to really understand how robust and relevant their solution is for you both now and long-term.

The pointOne Approach

At pointOne, we offer our own mobile order & pay app that requires no downloads or customer sign-ups and importantly, no commission costs. We are always happy to chat through options with you so feel free to get in touch.